Globally, 50 million people consider themselves to be ‘creators.’ 41% earn an income of $69,000 or more per year. Top influencers can make hundreds of thousands of dollars to even millions per year.

But can financial institutes identify these creators and verify their income sources?

The employment trends have seen a substantial change in recent years, with more and more workers earning from the growing ecosystem of the creator economy. These workers don’t work 9 to 5 or have a profit or loss statement like traditional businesses. They post on Instagram, make videos on YouTube, write on Substack, have a community on Patreon, and go viral via TikTok.

But financial lenders face a dilemma. The traditional ways of risk assessment and income verification don’t work in this case. How do they cater to this high-income yet untested and unverified group of professionals?

Lenders are accustomed to relying on regular paychecks to assess an applicant’s eligibility and underwrite a loan. Furthermore, these creators are primarily young, with little to no credit history. They acquire funds from multiple sources and don’t have an employer to attest to their profession.

Traditional factors like cash flow, credit scores, and income verification are not great indicators of the variable, ad-hoc nature of a creator’s finances.

So, how can financial institutions solve this issue? At Phyllo, we understood this problem and created a holistic platform that provides easy-to-access first-party data about creators and their income streams, all via APIs.

But before we deep-dive into how Phyllo is solving this issue, let’s have a look at the gaps in the current scenario:

Why is it difficult to verify a creator’s income?

Creators’ income is a first-party data not available in the public domain. The prevalent solution of analyzing bank statements only provides the consolidated amount in the account. Social media platforms often take up to 45 days to transfer the amount to the creator’s account!

Businesses, offering financial services to creators, are currently trying to solve this problem manually with screenshots of income and bank statements. But with the various income sources and hard-to-reverify images, the issue of income proofs still exists.

How is Phyllo’s API assessing the creator’s income data?

Phyllo’s income API provides automated and continuous data once a creator connects their account. Creators don’t need to compile pay stubs and invoices to prove consistent income streams manually. Phyllo provides the complete financial picture and reports all earnings automatically, in real-time, with permission from the creators themselves.

Here are some of the unique attributes of Phyllo APIs:

- Daily updates from all income streams, making it easier for financial institutions to verify the numbers

- Income information is segregated by transaction and date. Example: Monday - $10 - subscription revenue

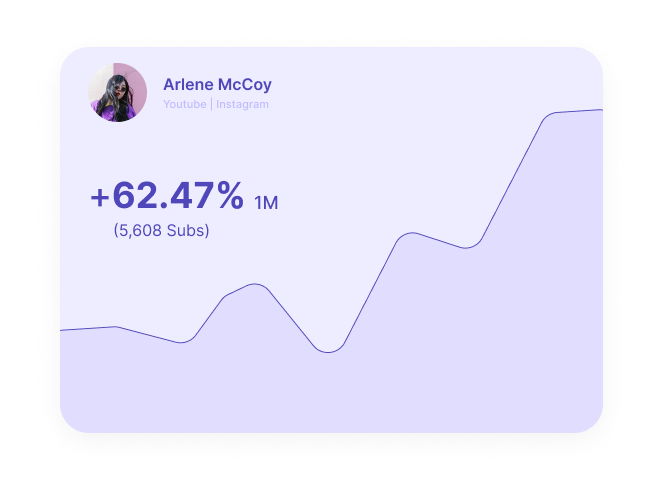

- With Phyllo APIs, you can review over 40 data points on each creator.

Some data points like subscribers, impressions, and revenue by activity are specific to creators. These can be crucial while validating an income stream. Phyllo also allows you to review historical earnings and see how a particular creator has successfully monetized their endeavors.

Income API: Business Impact

Any business that requires easy-to-access data about creators and their income streams across different platforms needs Phyllo’s Income API.

Businesses can:

- Streamline the underwriting process with access to first-party data

- Reduce manual processes like verifying screenshots

- Analyze historical data trends for better decision-making.

With detailed insights and trends into creators’ income from all platforms, lenders can now evaluate the ‘creditworthiness’ of creators and provide them with other flexible financing solutions.

Financial services providers like lenders, credit-card companies, etc. can also use Phyllo’s Identity and Engagement APIs to understand how the creator’s content performs, giving you a lead to their income potential.

Ready to provide lending solutions to creators?

With Phyllo, it is finally possible to gain the full visibility of each earning from every platform. With our solutions saving 80% of integration cost and time, using our APIs is a no-brainer for any business in the creator economy.

Ready to give us a go? You can try Phyllo in a sandbox environment here.

.avif)